What is Beneficial Ownership Information Under the CTA?

The Corporate Transparency Act (CTA) is a landmark piece of Federal legislation aimed at enhancing corporate transparency and combating illicit financial activities in the United States.

The crux of the CTA is the concept of "beneficial ownership," a term that carries substantial implications for businesses and individuals alike. This article delves into what it means to be a beneficial owner under the CTA, why it matters, and the responsibilities it entails.

What is the Corporate Transparency Act (CTA)?

The Corporate Transparency Act was enacted by the U.S. Congress as part of the Anti-Money Laundering Act of 2020. The CTA aims to curb money laundering, terrorist financing, and other illegal activities by requiring certain entities to disclose their beneficial owners to the Financial Crimes Enforcement Network (FinCEN). This new Federal compliance requirement for LLCs and Corporations is intended to close loopholes that have historically allowed bad actors to hide behind anonymous shell companies in the United States.

What Is Beneficial Ownership?

Under the CTA, a "beneficial owner" is defined as any individual who, directly or indirectly, through any contract, arrangement, understanding, relationship, or otherwise:

- Exercises substantial control over a reporting company.

- Owns or controls not less than 25 percent of the ownership interests of a reporting company.

What is "Substantial Control"?

Substantial control refers to the power to make significant decisions regarding the company's operations, policies, or management. This can include board members, senior executives (e.g. President, Vice President, CEO’s, COO’s,, etc.), or other individuals with the ability to influence major business activities such as Managers or Members of an LLC which are to be determined on a case-by-case basis.

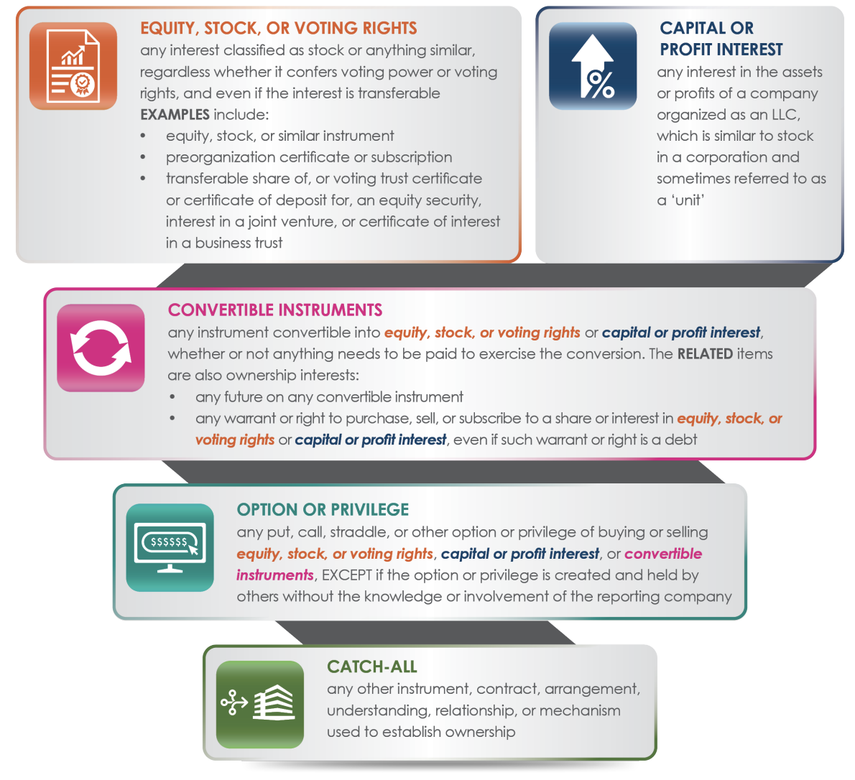

What does it mean to have an Ownership Interest?

Ownership interest encompasses equity stakes, voting rights, or other forms of ownership in the company. Individuals who own or control 25% or more of the company’s equity or voting power are considered beneficial owners.

What does it mean to have Indirect Control?

The CTA also recognizes indirect control, meaning that beneficial ownership can be exerted through various layers of ownership or through other means that confer effective control over the company. This ensures that the act captures complex ownership structures designed to obscure true ownership.

What Are the Reporting Requirements for Businesses?

Entities subject to the CTA must report beneficial ownership information to FinCEN. The required information includes:

- Full legal name

- Date of birth

- Address

- Unique identifying number from an acceptable identification document (e.g., passport, driver's license)

This information must be kept up-to-date, with changes such as change of legal name or address must be reported within 30 days.

What Are the Implications and Responsibilities for Businesses under the CTA?

The CTA places significant responsibilities on reporting companies and beneficial owners:

Compliance

Entities must establish procedures to identify and report beneficial ownership information accurately. Non-compliance can result in substantial penalties, including fines of $500 a day up to $10,000 and up to 2 years imprisonment for willful failure to file.

Privacy Concerns

While the CTA aims to enhance transparency, it also raises concerns about the privacy and security of the reported information. FinCEN is tasked with ensuring that the collected data is protected and only accessible to authorized personnel and entities.

Due Diligence

Companies must conduct thorough due diligence to identify their beneficial owners. This often involves unraveling complex ownership structures and ensuring that all significant owners and controllers are disclosed.

Conclusion

The Corporate Transparency Act represents a significant step toward enhancing corporate transparency and combating illicit financial activities in the United States. Understanding what it means to be a beneficial owner under the CTA is essential for business owners, legal professionals, and compliance officers.

Della Torre Law PLLC