As a result of the Fifth Circuit's emergency stay, the January 1, 2025 deadline for the Corporate Transparency Act — which requires over 33 million businesses in the United States to file beneficial ownership information or face penalties of up to $10,000 — has been reinstated.

FinCEN has appealed a recent federal court ruling that temporarily blocked the Corporate Transparency Act (CTA) and its Beneficial Ownership Information Reporting (BOIR) rules. Along with the appeal, FinCEN has requested an emergency stay to reverse the injunction and potentially reinstate the January 1, 2025, compliance deadline. If granted, businesses would need to comply with the reporting requirements, which include disclosing ownership details.

The Financial Crimes Enforcement Network (FinCEN), a bureau of the U.S. Department of the Treasury, enforces regulations to combat financial crimes in the United States.

With new BOIR compliance, LLCs and corporations must file reports detailing beneficial ownership to FInCEN.

FinCEN issues two types of IDs: one for reporting companies and another for individuals. It is important to understand important distinctions between the two.

The Financial Crimes Enforcement Network (FinCEN) safeguards the financial system against illicit activities using the Beneficial Ownership Information Reporting (BOIR) E-Filing System, enabling electronic submissions by financial entities. Users often face the "Invalid attachment" error, which occurs due to improper file formats (only JPG/JPEG, PNG, PDF accepted) or filenames with spaces/invalid characters. To resolve this, ensure files are correctly formatted and named.

The Corporate Transparency Act (CTA) mandates that entities disclose their beneficial owners—those who control or own at least 25% of a company or exercise substantial control. This legislation aims to combat money laundering and other illegal activities by closing loopholes that allowed anonymity in business ownership. Companies must report beneficial ownership details to FinCEN, including names, addresses, and identification numbers, with severe penalties for non-compliance.

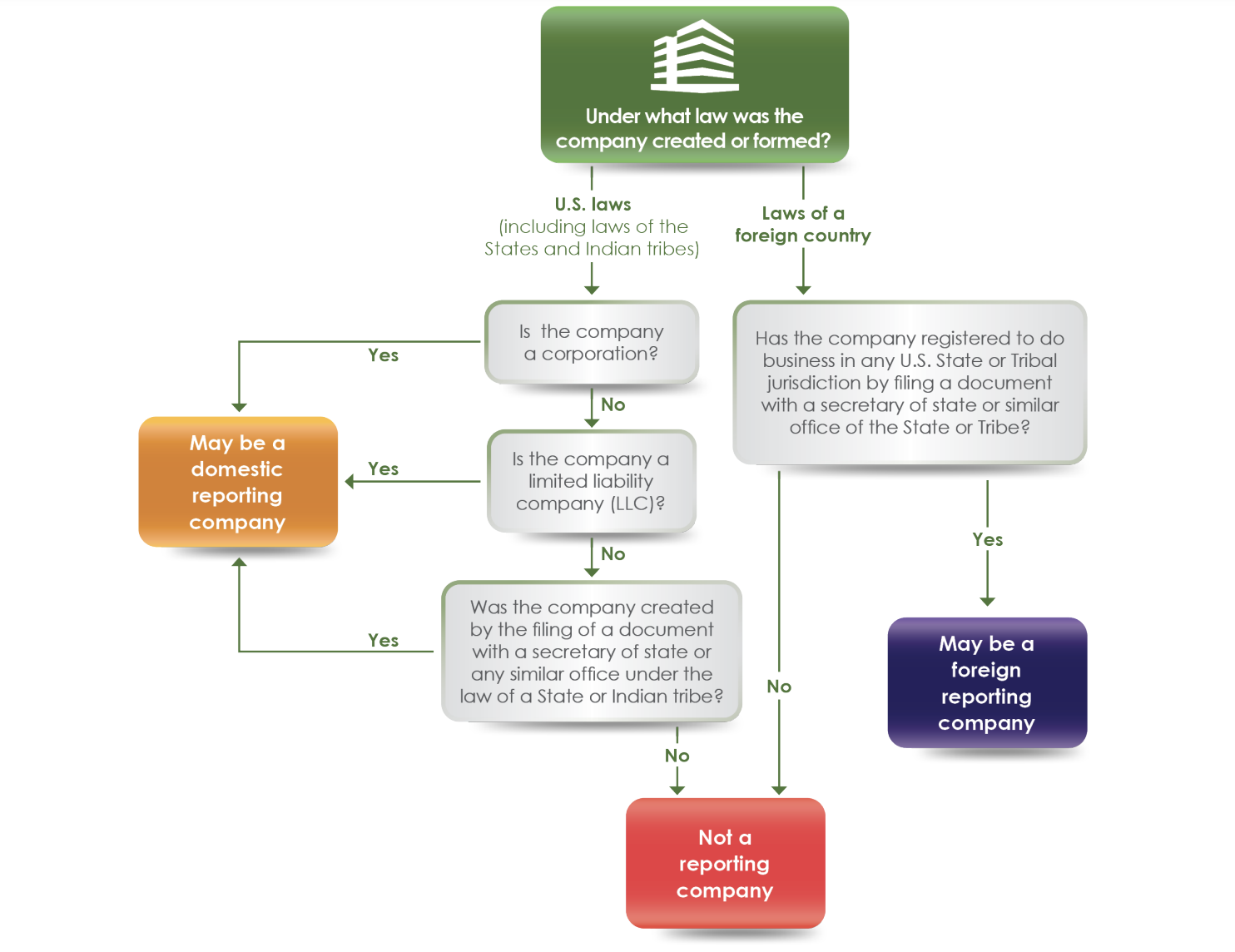

A "Reporting Company" includes most corporations and LLCs but exempts large operating companies, regulated entities, inactive entities, and certain nonprofits. Reporting Companies must provide detailed beneficial ownership information to FinCEN and update changes within 30 days.

Sunbiz, the Florida Department of State's online portal, has issued a notice to LLCs about a new federal reporting requirement. Starting January 1, 2024, most U.S. corporations, LLCs, and similar entities must report beneficial ownership information to FinCEN under the Corporate Transparency Act. Key deadlines include filing initial reports by January 1, 2025, for entities existing before 2024, and within 90 or 30 days for those created after January 1 2024 and 2025, respectively.

The Corporate Transparency Act (CTA) requires U.S. companies to report their beneficial owners—those with substantial control or 25% ownership—to the Financial Crimes Enforcement Network (FinCEN) to combat financial crimes.

Reporting is mandatory by January 1, 2025, with updates within 30 days of changes. Entities dissolved before January 1, 2024, are exempt from reporting if the dissolution was formal and complete.

Administrative dissolutions do not exempt companies from reporting.

Compliance with the Corporate Transparency Act (CTA) in the U.S requires updating Beneficial Owner Information Reports with FinCEN.

Single-member LLCs and closely held corporations may only need a one-time report, but multi-member LLCs and corporations with multiple shareholders must continually update their beneficial owner information to avoid penalties of $500 per day, up to $10,000.

Changes in ownership, management, or personal details must be reported within 30 days.

FBAR compliance is crucial for U.S. persons and entities with foreign financial accounts exceeding $10,000 at any time during the year.

The FBAR, FinCEN Form 114, must be filed annually by April 15 (with an extension to October 15).

Non-compliance can result in severe civil and criminal penalties.