A federal judge in Texas has officially blocked the U.S. Federal Trade Commission (FTC) from enforcing a nationwide ban on non-compete agreements in the United States. This means that the provisions of the FTC’s ban – which were scheduled to take effect nationwide on September 4, 2024 - will no longer take effect for the time being.

In Florida, shareholders of corporations and members of LLCs have legal rights to inspect corporate records. Shareholders can review financial statements, shareholder lists, and other key documents by giving at least five business days' notice, provided the request is made in good faith. LLC members have similar rights under Section 605.0410, with access to records like member lists and financial documents.

Maintaining adequate corporate books and records protect the limited liability of a legal entity. Proper records help prevent "piercing the corporate veil," which could hold shareholders personally liable. In states like Florida and Delaware, shareholders have rights to inspect these records under certain conditions.

This article provides a thorough overview of single-member LLCs, a popular business structure for international companies looking to establish a U.S. presence. The key benefits highlighted include limited liability protection, tax flexibility, and ownership flexibility without residency requirements. Legal considerations are also covered, such as the importance of an operating agreement, maintaining the corporate veil, and regulatory compliance.

The Financial Crimes Enforcement Network (FinCEN) safeguards the financial system against illicit activities using the Beneficial Ownership Information Reporting (BOIR) E-Filing System, enabling electronic submissions by financial entities. Users often face the "Invalid attachment" error, which occurs due to improper file formats (only JPG/JPEG, PNG, PDF accepted) or filenames with spaces/invalid characters. To resolve this, ensure files are correctly formatted and named.

The FTC has banned non-compete agreements in the U.S., marking a major shift in employment law. This move enhances job mobility, wage potential, and entrepreneurship, though NDAs and trade secret protections remain in force. Non-competes previously restricted employees from working for competitors or starting similar businesses post-employment. The ban supersedes state laws, requiring employers to pivot to stronger NDAs, trade secret protections, and improved employee retention strategies.

Businesses in Florida must file an Annual Report through SunBiz to stay compliant and avoid penalties. SunBiz, the state's official portal, facilitates filings and updates for LLCs, corporations, and partnerships. Key requirements include filing by May 1st, updating registered agents, verifying business info, and paying a fee (about $138.75). Non-compliance can result in late fees up to $400 and/or administrative dissolution of the LLC or Corporation in Florida.

A holding company is a type of business entity that owns and controls the shares or membership interests of other Corporations or LLCs, respectively. Unlike business entities that focus on sale of goods or providing services, a holding company’s primary function is to hold a significant portion of the ownership interests in other businesses. This allows the holding company to influence or control the operations and policies of these subsidiary companies, which can can have several benefits...

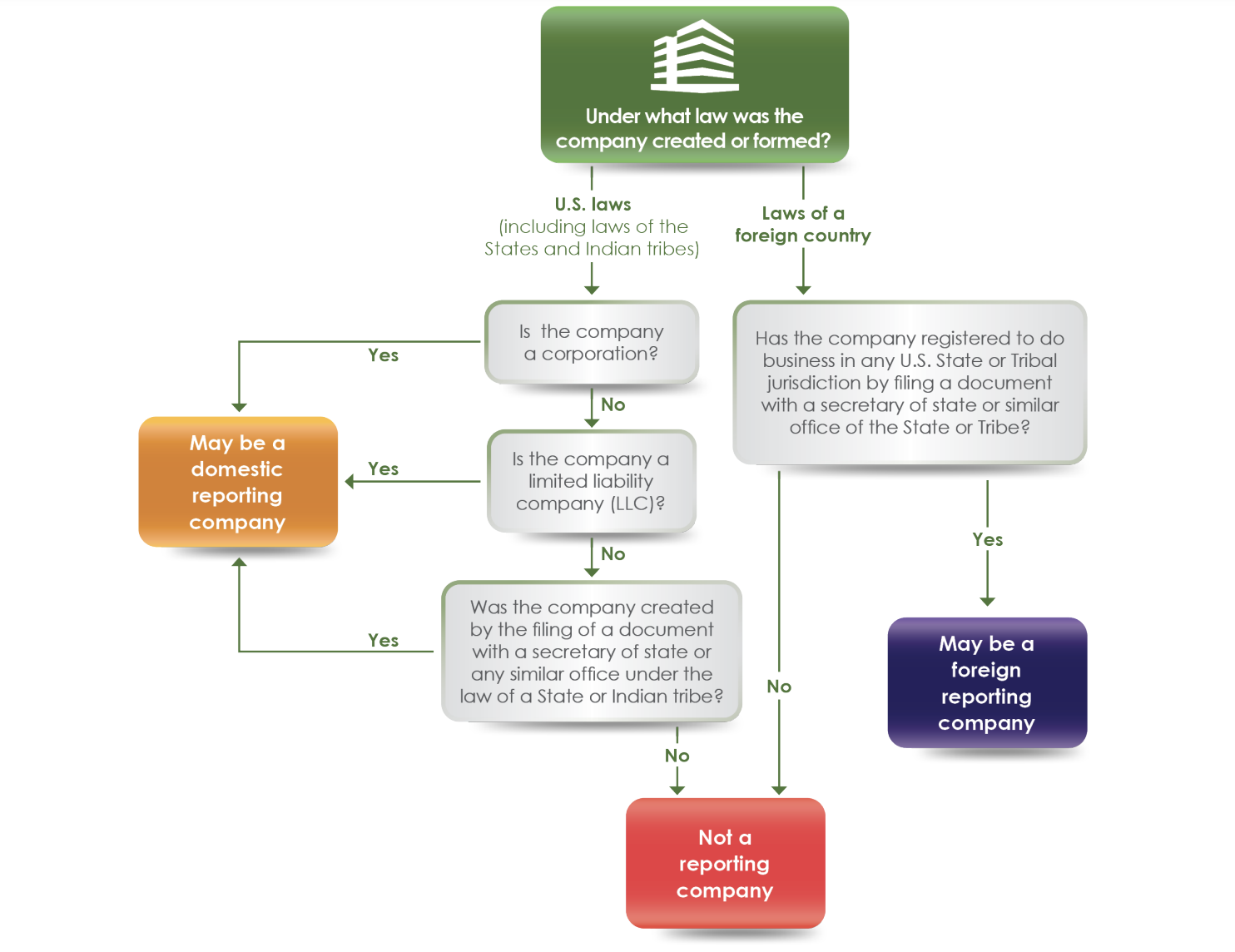

A "Reporting Company" includes most corporations and LLCs but exempts large operating companies, regulated entities, inactive entities, and certain nonprofits. Reporting Companies must provide detailed beneficial ownership information to FinCEN and update changes within 30 days.

New York has updated its LLC laws to enhance corporate transparency, effective January 1, 2026. These changes require LLCs to disclose beneficial ownership information to the state, mirroring the federal Corporate Transparency Act (CTA) and FinCEN's Beneficial Ownership Information Reporting (BOIR). The CTA, effective January 1, 2024, mandates that most entities report their beneficial owners' details to FinCEN.