This article provides a thorough overview of single-member LLCs, a popular business structure for international companies looking to establish a U.S. presence. The key benefits highlighted include limited liability protection, tax flexibility, and ownership flexibility without residency requirements. Legal considerations are also covered, such as the importance of an operating agreement, maintaining the corporate veil, and regulatory compliance.

Updating a Manager's or Director's residential address on Sunbiz is crucial for Florida LLCs and corporations to stay compliant and receive important legal notices. Also, ensure Beneficial Ownership Information is updated with FinCEN within 30 days of the address change. Follow the steps on Sunbiz to update your address, including providing details like business name, registration number, and new addresses.

The Financial Crimes Enforcement Network (FinCEN) safeguards the financial system against illicit activities using the Beneficial Ownership Information Reporting (BOIR) E-Filing System, enabling electronic submissions by financial entities. Users often face the "Invalid attachment" error, which occurs due to improper file formats (only JPG/JPEG, PNG, PDF accepted) or filenames with spaces/invalid characters. To resolve this, ensure files are correctly formatted and named.

An Operating Agreement (OA) for an LLC, though not always legally required, is crucial for business success. It outlines members' rights, responsibilities, and management structure, helping to prevent disputes, anticipate problems, and facilitate fair business sales.

Having an OA provides clarity and can protect members' interests, ensuring smoother operations and fewer conflicts.

Consult a lawyer to draft a tailored and detailed agreement for your LLC.

Businesses in Florida must file an Annual Report through SunBiz to stay compliant and avoid penalties. SunBiz, the state's official portal, facilitates filings and updates for LLCs, corporations, and partnerships. Key requirements include filing by May 1st, updating registered agents, verifying business info, and paying a fee (about $138.75). Non-compliance can result in late fees up to $400 and/or administrative dissolution of the LLC or Corporation in Florida.

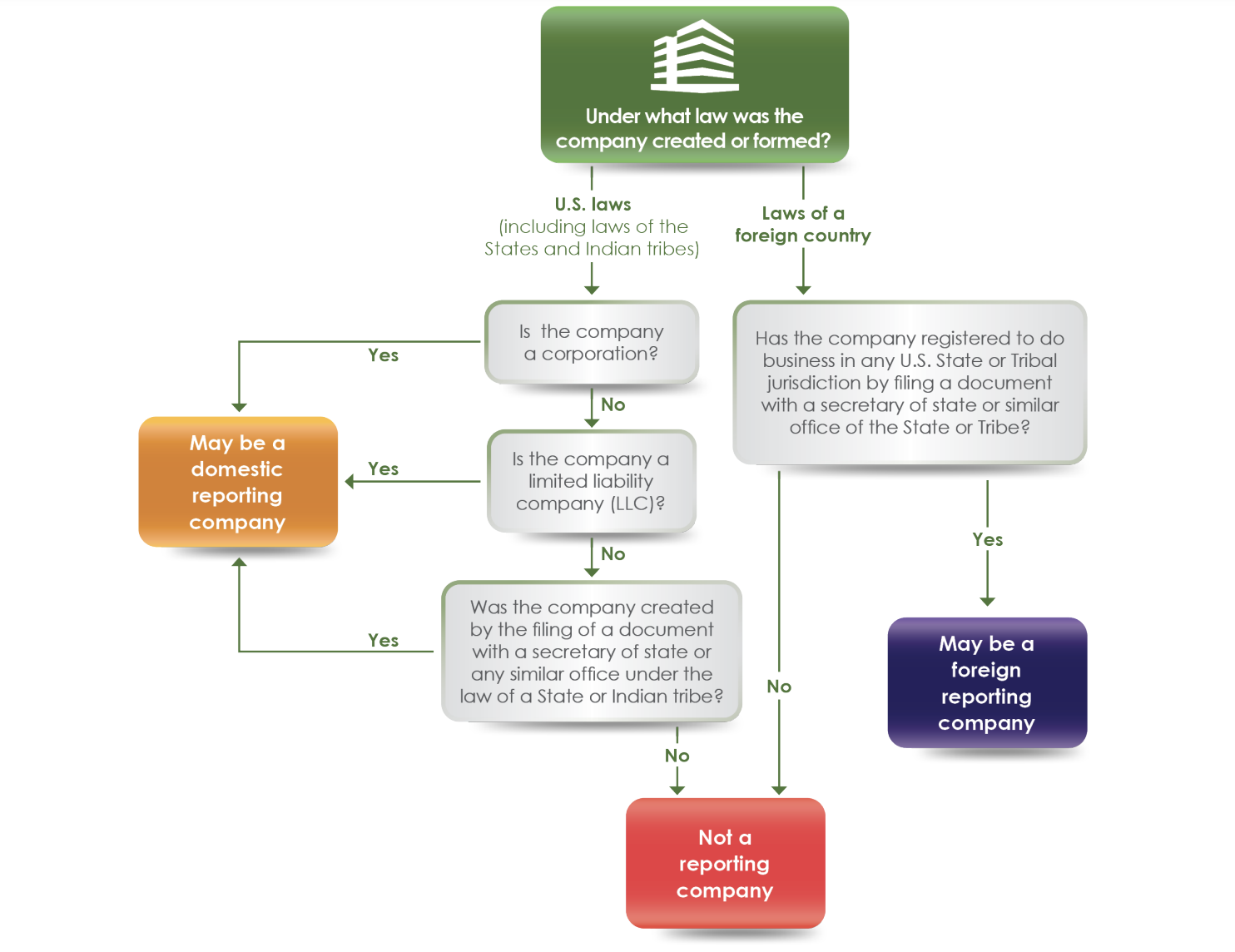

The Corporate Transparency Act (CTA) mandates that entities disclose their beneficial owners—those who control or own at least 25% of a company or exercise substantial control. This legislation aims to combat money laundering and other illegal activities by closing loopholes that allowed anonymity in business ownership. Companies must report beneficial ownership details to FinCEN, including names, addresses, and identification numbers, with severe penalties for non-compliance.

A "Reporting Company" includes most corporations and LLCs but exempts large operating companies, regulated entities, inactive entities, and certain nonprofits. Reporting Companies must provide detailed beneficial ownership information to FinCEN and update changes within 30 days.

Sunbiz, the Florida Department of State's online portal, has issued a notice to LLCs about a new federal reporting requirement. Starting January 1, 2024, most U.S. corporations, LLCs, and similar entities must report beneficial ownership information to FinCEN under the Corporate Transparency Act. Key deadlines include filing initial reports by January 1, 2025, for entities existing before 2024, and within 90 or 30 days for those created after January 1 2024 and 2025, respectively.

New York has updated its LLC laws to enhance corporate transparency, effective January 1, 2026. These changes require LLCs to disclose beneficial ownership information to the state, mirroring the federal Corporate Transparency Act (CTA) and FinCEN's Beneficial Ownership Information Reporting (BOIR). The CTA, effective January 1, 2024, mandates that most entities report their beneficial owners' details to FinCEN.

The Corporate Transparency Act (CTA) requires U.S. companies to report their beneficial owners—those with substantial control or 25% ownership—to the Financial Crimes Enforcement Network (FinCEN) to combat financial crimes.

Reporting is mandatory by January 1, 2025, with updates within 30 days of changes. Entities dissolved before January 1, 2024, are exempt from reporting if the dissolution was formal and complete.

Administrative dissolutions do not exempt companies from reporting.